Headlines in June all revolved around the battle between Iran, Israel and the US. Again we experienced the roller coaster of prices but in reality markets acted pretty responsibly and of course cautiously. Hopefully now we have some sort of lasting peace. This meant that Q2 looked more like a normal trading period and less like the waves of headline induced buying and selling that hit everyone in Q1. Thankfully we started the recovery phase, with our flagship AiQP strategy up just over 9% for the quarter.

Headlines in June looked like this ;

- Circle’s IPO was a raging success with an almost 200% rally, the group trading at $18.4 billion market cap after just 3 days, despite a net income of just $156 million in 2024. Nice premium!

- We went through $300 billion of investment into the crypto space through equity purchases of Digital currency treasury companies. It seems when you cant buy crypto you buy shares in crypto companies – long may it continue.

- Despite some persistent OG BTC selling, institutions kept buying ETF’s with net $15 billion of inflows from the end of April. With rumours of Ripple and Solana ETF’s more is expected.

- Microstrategy closes in on 600,000 BTC and with prices above ATH’s as I write, they have weathered the storm – or so it seems!

- Both XRP and Solana look like breaking trend lines at the end of June, leading into July.

- The US senate passed the GENIUS Act establishing federal regulations for stablecoins.

- Trump Media filed for an ETF that allocates 75% to BTC and 25% to ETH – if that doesn’t signal BULL for the US in crypto I don’t know what does.

- Blackrock signals its intention to ETF, Ada, Sol and Dot.

- Bittensor’s development activity surged 3,600% in June – the nerdy kids have started building big time again!

- BTC breaking new all time highs and staying there, has shown a 20% increase in the following 2 months in the past. With benign inflation data on the 15th July $130K BTC may well be in sight. Let’s see.

How did we perform in Q2 – I suppose the real answer is OK and we do have some major headlines of our own!

- As I write we are just passing $100 million AUM. This is a huge performance by our team. We run 52 different SMA’s and technologically we are doing things that no-one else in crypto is achieving. I don’t know any other company capable of trading this many SMA’s all done without a pecking order and risk managed to the highest calibre.

- Our flagship multi strategy AiQP made almost 9% net of fees for the quarter, which is bang in line with how it is meant to perform, obviously we are playing catch up after a Q1 drawdown but H2 has always been positive and the signals currently, look good to get to our target range of 30-40% net of fees with a max D/D of just 10%.

- Market Neutral is up 2.9% YTD and has weathered the choppy storms exactly as it is meant to. Again the target is 15-18% net of fees with 4% drawdowns and we think that is definitely achievable in 2025 to back up 2023 and 2024 and showing it to be one of the most rock solid strategies for Corporate Treasury Management using BTC, ETH, XRP, SOL.

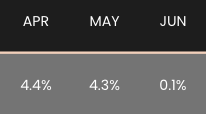

AiQP 2nd Quarter results – net of fees

Generally we full bullish about trading conditions, however, as I have often pointed out, we don’t make discretionary trading decisions. As long as the trades remain within our risk analysis we allow our time proven algorithms to make the trades.

One piece of important news is that for those who cant invest in an SMA or simply prefer the fund structure, we will shortly have a regulated and audited fund that will allow everyone to be able to invest in our AiQP strategy.

If you would like to know more about this fund structure please email me and we can meet up and talk through the jurisdictions, regulation, audit and admin. This is all part of Algoz moving from $100 million under management to $500 million in the next two years.