I will leave you to work out who is who in that headline but suffice to say the parting of Elon Musk from the Trump administration, whilst always inevitable as a timeline, did not go smoothly. It’s a shame because things were shaping up well in the crypto world.

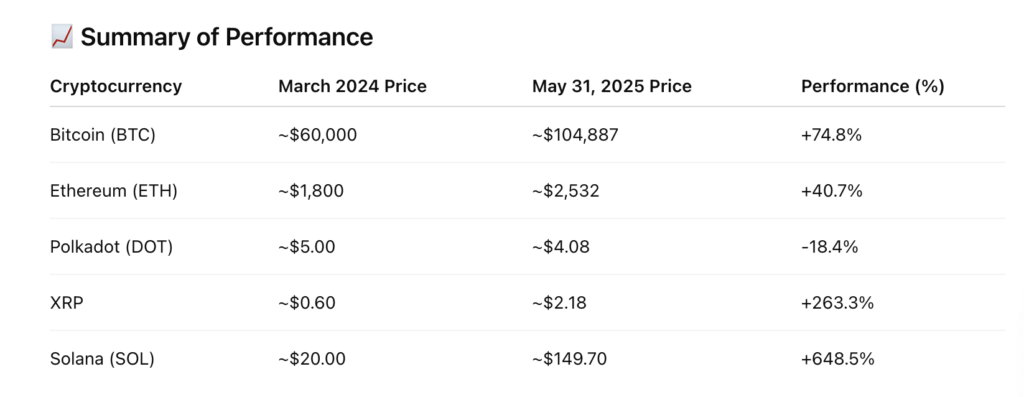

- We had the unexpected approval of the Ethereum ETF which saw the price of the coin rise from $1800, to a high of $2700 on 29th May, giving back a little recently but a significant 50% rise in that time frame. People also liked Vitaliks 19th May roadmap to scale.

- BTC followed suit from $94,000 to $111,000 on the same date, just before the “big Whitehouse split”

- Link up 40%, Sol 30% and Doge 20% – all followed suit.

- On the downside, more and more people started questioning the Microstrategy leveraged playbook and wondering if this so called house of cards could leave hapless retail customers ‘Holding the baby”. However, if you hold Microstrategy I urge you to read up on just how they say they are creating Yield – it doesn’t look like any lasting Yield generation that I have ever seen, unless of course you believe people will just keep investing forever!! They did however just raise $980 million, discounting shares to do so.

- Tech giants continue to put in stellar figures and this is underpinning the macro market and stopping the Tariff tantrums from spoiling the party.

- BTC is continuing its outperform in the market leaving alt coins in its wake.

- Solana looks under pressure currently and XRP is recovering from a sharp sell off triggered by some large token transfers but holders remain confident that this ETF is now not far away.

- Dogecoin too, looks under pressure. Sui is having a good run as more and more builds use their platform.

- Circle’s recent IPO bucks the waning US IPO trend and pulls in a massive $24 billion with the closing day 1 price showing a 150% plus premium. This shows the corporate US appetite for all things related to crypto. The same applies for other related Crypto stocks who are enjoying new highs.

So how did we do in May? Another excellent month.

- Market Neutral was up just short of 2% net of fees and 3.2% year to date

- Momentum was up 2.8%, which was a little lower than we hoped but again positive.

- AiQP, our flagship strategy was up 4.3% net. (tear attached)

To some these figures may not sound huge but the first 5 months of 2025 have been amongst the most difficult on record for crypto algorithmic traders. The constant macro change of direction out of America and then the rest of the world holding its breath from one international stand off to another, just wreaks havoc with signals. Yet for 3 of the 5 months we have been positive and all of our strategies are outperforming the Barclays Crypto Hedge Index which is down almost -9% year to date.

Looking over our past years trading it is also apparent that we have made a greater yield in H2. Our recent upgrades are already showing positive gains as we gradually increase their impact on our strategies. Now might just be the perfect time to engage us to work for you!

If you would like to have a copy of our latest fact sheets for all 3 strategies then please just email and request.