BTC has hit all time highs again. So what now? Its important to remember at Algoz, we are systematic quant traders, so the daily direction of the market is relatively unimportant to our Algorithm’s; what we like is strong moves in either direction but as always its important to understand what is happening and why, so lets start by trying to understand what is driving this rally and why it might be a strong bull market. Here’s the key things to focus on.

- Currently the ETF’s are buying circa 9,000 BTC coins a day and the miners are producing just 900 coins a day. There are very few sellers around so you can see what is driving the price – over demand under supply. Simple.

- What if the ETF dries up? Well I fully expect it to lessen off with US buying but on April 19th the halving occurs and then, at the current hashrate, miners will only be able to produce 450 coins a day, so even if the appetite halves for US ETF’s then there will still be the same percentage shortage on a daily basis.

- New countries are coming on stream with their ETF’s. March 1st was the first day of trading for Blackrock’s Brazil spot BTC ETF and we know that Brazilians love crypto and that it takes a few weeks to build momentum – that should take up any slack in the ETF market from the US.

- JP Morgan – remember Jamie Dimon saying Crypto was a “ponzi scheme” apparently they have now realised they missed the ETF boat and look like filing shortly.

- More countries across the globe are now processing spot ETF applications.

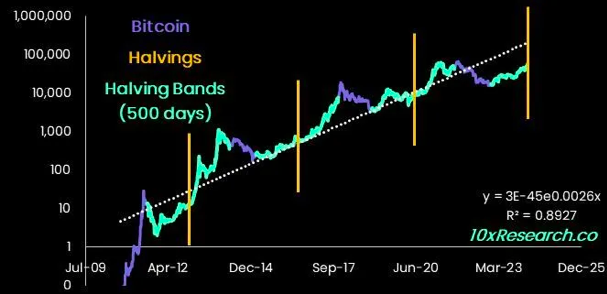

- When you look at the previous three Halvings they all signalled Bull markets for Crypto and they all had a symmetry about them. The current graph shows we are not quite half way into this next bull run. Based on the correlation of the previous 3 Markus Thielen, who we follow closely predicts the top of the Bull run to be between April 25 and September 25. (with thanks to 10xResearch for the image below)

- So where does that leave BTC – many now believe BTC will be $100K by Christmas. (not investment advice – just market thoughts). It may get their sooner but there will undoubtedly be a few shakeouts between now and then and of course some profit taking. However, if Michael Saylor, convinced Jeff Bezos, over dinner recently, to buy BTC with the $8.5 billion he sold in Amazon shares the day after their dinner, then we may not see that sell off for a little while.

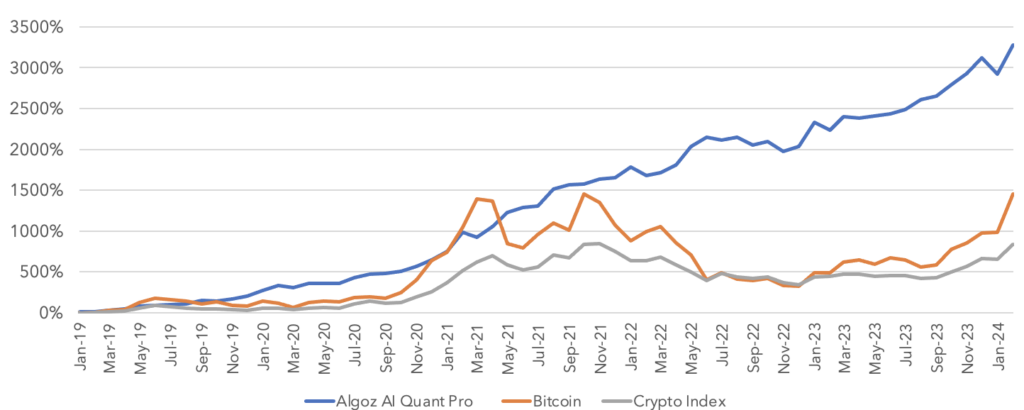

Another Amazing Month for ALGOZ.

- Our most popular strategy AI Quant Pro made a mouth watering 11.7% net of fees last month.

- So for all those people using our Quant Pro product who gave us BTC to trade for them, they saw the value of their coin increase 43.7% and we added another 11.7% making a staggering 55% in the month. If you were using ETH, a whopping 53% on price and again 11.7%. An incredible 65% in the month. (coin figures provided by Coingecko)

- Those with USDT didn’t miss out either as we ran a Carry trade on top of the strategy and improved the 11.7% to almost 20%.

So what happens next?

- Firstly, we wont have months like that every month. We will have losing months, just like we did in January this year and in February last year.

- There will be some profit taking and with so much leverage in the market (we don’t run leverage on our strategies) the exchanges will try to shake out the leverage retail players. They always do!

- The key is not to panic when it happens – it’s a short term play and our aim is to keep trading successfully for the next 3-5 years, not just a few months and deliver good returns over time.

Many believe this is a sea change for Crypto. The largest asset managers in the world are now in play and providing credibility and marketing, all about Crypto. We may just be at an inflection point in the industry. If you dont have a strategy for Crypto then may simply miss this cruise liner (its far bigger than a boat). If you dont have a position, you haven’t missed it yet as I pointed out earlier. But now is the time to act.

Our Quant Pro product that significantly mitigates exchange and management counterparty risk whilst giving you exposure to our key strategies is still unique in Crypto and we have proven, categorically to our investors that there is a safer, better way to invest. We are still also, one of the only Assets Managers, who allows you to use BTC or ETH so you can keep your exposure to those coins and then earn as well, using the collateral of those coins. That’s special.

We also run a series of SMA’s for large allocators using sub wallets within their accounts at exchanges, if they are comfortable with Binance or OKX etc, then we are happy to trade for them within their account. Total flexibility.

Now is the time to book a meeting with me to understand how you can benefit from our Award winning strategies and enjoy the complete protection that Quant Pro gives you.

Stephen Wundke, Global Business Development Director – Algoz

*Note – Market thoughts are meant solely as an explanation of what is happening in the world of crypto. Algoz is not a discretionary trader. Algoz is a systematic Quant trader, governed by Algorithm’s with up to 5 years of trading data.